how to pay taxes on coinbase

Stayyfr0styy 1 yr. Once you log in to your Coinbase account your transactions are automatically synced.

How To Do Your Coinbase Taxes Coinledger

That will tell you your capital gainloss.

. If you sell or spend your crypto at a loss you dont owe any taxes on the. Coinbase is the most recent major cryptocurrency exchange to offer a Visa debit card. Also with a little bit more effort travel points cards can offer a value of 001-010 per point.

You have to do it for each. The exact rate depends on a few factors but its almost always lower than the rate youd pay on short. Select Add a payment method.

You can see the full. OnlyFans is the social platform. Do You Have To Pay Taxes On Coinbase.

Select the type of account you want. All you need to do with a crypto tax app is add your Coinbase Pro API keys or upload your Coinbase Pro CSV files and let your crypto tax calculator do the rest. You may not have to âpayâ taxes if you only had capital losses however you still have to report your crypto.

You only owe taxes if you spend or sell it and realize a profit. Heres some good news for crypto taxes. Coinbase Pro Tax Reporting.

Log in to your Coinbase account to Cointelli. In short it depends. The Coinbase debit card offers a percentage of your purchase as a cash-back reward.

If you purchased the NFT less than one year ago your proceeds from. Coinbase Tax Reporting. Cointelli supports Coinbase-Pro in its calculations so no worries.

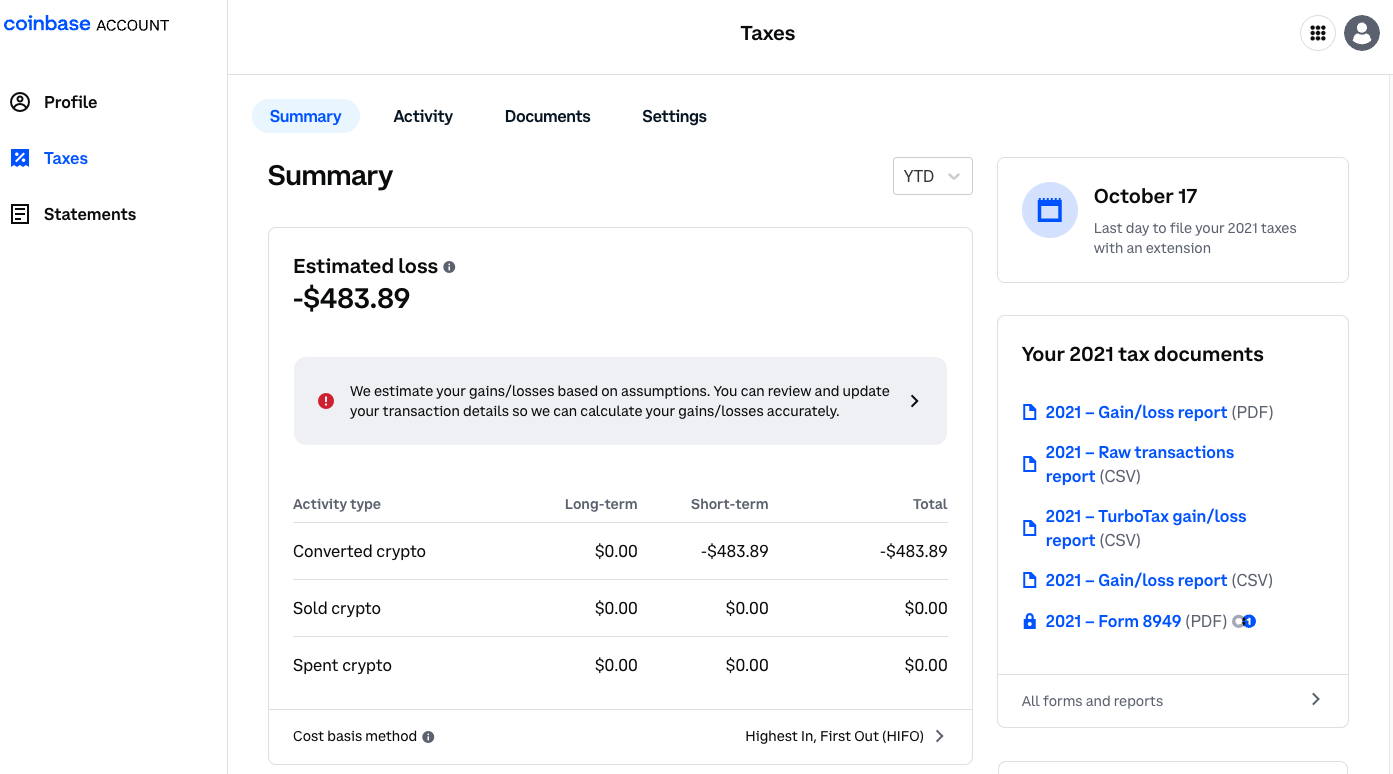

The first step toward calculating your overall crypto taxes is to import your data onto our platform. If you use Coinbase you can sign in and download your gainloss report using Coinbase Taxes for your records or upload it right into TurboTax whenever youre ready to file. If you earn 600 or more in a year paid by an exchange including Coinbase the exchange is required to report these payments to the IRS as other income via IRS Form 1099.

To link a payment method. You only have to do one of. You can generate your gains losses and income tax reports from your Coinbase Pro investing activity by connecting your account with CoinLedger.

You originally bought an NFT for 2500 in ETH and after its value rose to 10000 in ETH you sold the NFT for cash. If you use the Coinbase Wallet tax reporting API with a crypto tax app - all your Coinbase Wallet transaction history will be automatically imported to your chosen app. You can generate your gains losses and income tax reports from your Coinbase investing activity by connecting your account with.

These gains are taxed at rates of 0 15 or 20 plus the NII for higher incomes. Go to Payment Methods on web or select Settings Payment Methods on mobile. The net investment income tax NIIT is a 38 tax on investment income like capital gains dividends and rental property income.

Take how much you paid for the currency and subtract that from how much it was worth when you sold it for fiat. Multiple purchases including subscriptions might be grouped onto one charge. You can just transfer the XLM to Coinbase pro for free and sell.

If you mined crypto youll likely owe taxes on your earnings based on the fair market value often the price of the mined coins at the time they were received. The tax only applies to high-income taxpayers single. To see the full receipt including tax tap or click the date.

Don T Hide Virtual Currency Bitcoin From Irs This Tax Season

Cryptocurrency Taxes A Guide To Tax Rules For Bitcoin Ethereum And More Bankrate

Best Coinbase Tax Calculator 2022

Does Coinbase Report To Irs All You Need To Know

If You Thought Nfts Were Crazy Wait Til You See How They Re Taxed Politico

Coinbase Launches Free Tax Center To File Crypto Taxes Easily

Want Your Tax Return In Crypto Turbotax Can Send It To Your Coinbase Account Pcmag

.jpeg)

How To Do Your Coinbase Taxes Coinledger

The Ultimate Coinbase Pro Taxes Guide Koinly

Coinbase Unveils New Tax Support Features As Irs Increases Crypto Scrutiny Cnet

How To Do Your Coinbase Taxes Coinledger

Crypto And U S Income Taxes When And How Is Crypto Taxed As Income Coinbase

Tax Forms Explained A Guide To U S Tax Forms And Crypto Reports Coinbase

Does Coinbase Report To The Irs Tokentax

File Taxes With Turbotax And Get Tax Refund Into Coinbase Account

How To File Taxes If You Sold Crypto In 2021 The New York Times

Paying Taxes On Bitcoin Is Surprisingly Simple

Does The Irs Have Your Coinbase Data Crypto Briefing

Crypto And U S Income Taxes When And How Is Crypto Taxed As Income Coinbase